Accounting questions and answers. Unless expressly provided to the contrary by this Act no one shall be in any.

Deleted by Act A722.

. Purposes Operation Estimates Virements Yearly Statements of Accounts Objectives. Minister means the Minister charged with responsibility for finance. Bad debt relief.

PART II FEDERAL LAND DEVELOPMENT AUTHORITY Establishment Duties and Powers Establishment duties and powers of Authority 3. To be in charged for the public moneys collected received held or disbursed and all public stores received held and disposed. ENACTED by the Parliament of Malaysia as follows.

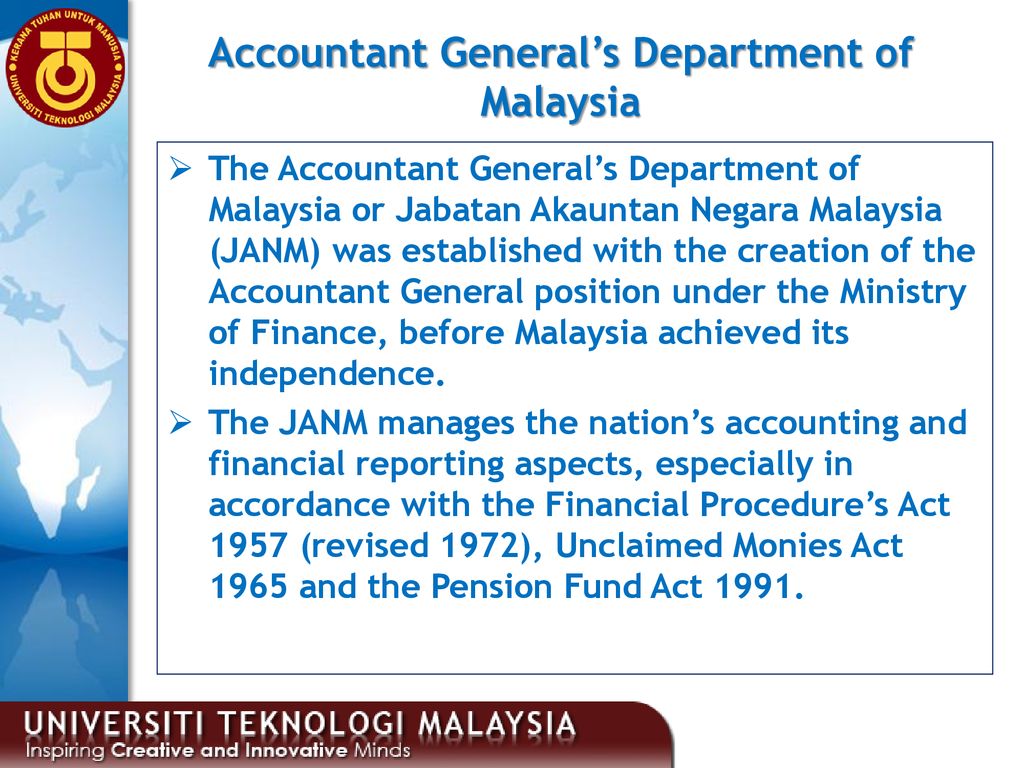

Financial Procedure Act 1957 and any regulations made and instructions issued thereunder shall apply to the Director and other persons in the service of the Water Department. Financial Procedure Act 1957 Lecture Outline Main objectives of Financial Procedure Act 1957 FPA 1957 Definition duties of Controlling and Accounting Officers Financial Authority Consolidated Funds of Federal States Government Public Trust Funds. It includes procedures for the collection custody and payment of the.

The Menteri Besar may with the concurrence of the Minister make such rules as are necessary for the purposes of this Act. Spend in development programmes of the country. To secure proper exercise of.

It includes procedures for the collection custody and payment of the public monies of Malaysia and of the States and also the purchase custody and disposal of public. Short title and commencement 1. 2 This Act comes into operation on a date to be appointed.

Evaluation comparison of budgeted and actual revenue expenditure. Refund of tax etc overpaid or erroneously paid 58. 2 categories of functions of budget.

Control ensure that the objectives of budget is achieved. 1 There shall be established for the purposes of this Act a body to be known as the Federal Land Development Authority. 1 This Act may be cited as the Financial Procedure Amendment Act 2014.

Explain briefly four 4 duties of the controlling officer according to Section 15A of the Financial Procedure Act 1957. Non-applicability of section 14a of the Financial Procedure Act 1957 Pa r t Vii RELiEF REFUND AND REMissiON 56. In accordance with the Financial Procedure Act 1957 Act 61 Treasury Instruction and the concept of Let Managers Manage the Controlling Officer is responsible for ensuring that all policies related to the expenditure are done carefully efficiently effectively have value for money and adhere to best practices so that financial management is controlled and transparent.

It is to surcharge sum as the commission may think fit. To control the authorised estimates for the particular purpose. Power to make rules 12.

Financial Procedure Act 1957. 2 This Act comes into operation on a date to be appointed. 6 Laws of Malaysia ACT 370 Saving 4.

Section 16 1 of the Financial Procedures Act 1957 states that the public sector financial authority shall for the purposes of Section 9 of the Audit Act 1957 as soon as possible report the finances after the end of each relevant financial year. The Financial Procedure Act 1957 Revised 1972 provides for the control and management of the public finances of Malaysia and outlines financial and accounting procedures. Section 7 a of the Financial Procedure Act 1957 All types of money or revenuereceived except for loans and trusts are to be accounted for in the ConsolidatedRevenue Account Section 7 b of the Financial Procedure Act 1957 Consolidated Loan Account isestablished by the federal or the state government to keep all.

Financial Procedure Amendment 1 A BILL i n t i t u l e d An Act to amend the Financial Procedure Act 1957. Power of Minister to grant relief 57. Answer to Section 16 1 of the Financial Procedures Act 1957.

Financial Procedure Act 1957 Act 61. This Act may be cited as the Goods and services Tax Act 2014. Not only that surcharge is the method that government use to recover all the losses made by the government that.

Involves taxation measures to provide revenue for the government to. According to Section 18 of Financial Procedure Act 1957 it states that surcharge is for government servants that failed to collect money improper payment fail to keep proper account and many more. The Financial Procedure Act 1957 Revised 1972 provides for the control and management of the public finances of Malaysia and outlines financial and accounting procedures.

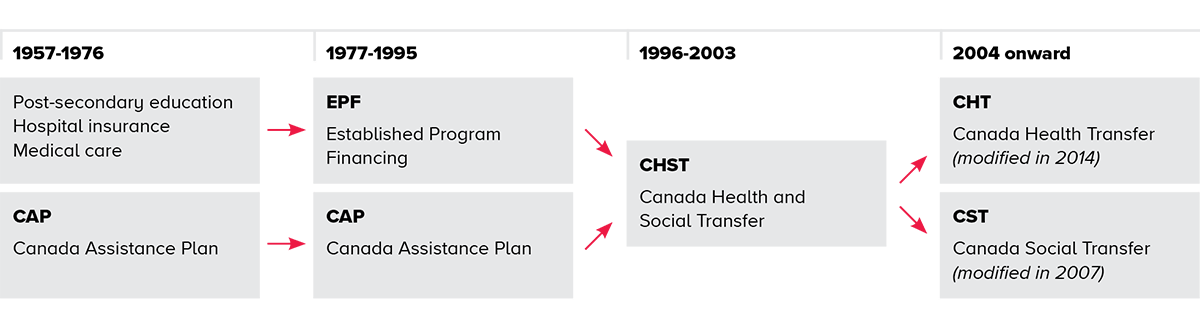

What Now Canada Health Transfer Background And Future Canada West Foundation

Pdf Accrual Accounting In Government Is Fund Accounting Still Relevant

Accountant General S Department Of Malaysia Agd Federal Government Financial Statement

Pdf Accrual Accounting In Government Is Fund Accounting Still Relevant

Pad190 Principles Of Public Administration Ppt Download

Federal Legislation Affecting People With Disabilities Where We Are Today

Pdf The Origins Of The Financial Crisis

Pdf Constitutional And Financial Legal Aspects Of The State Budget In The Republic Of Bulgaria

Nato Topic Transparency And Accountability

Pad190 Principles Of Public Administration Ppt Download

Overview Of Accounting Ppt Download